Discipline is hard, and life can feel like a bit of a crapshoot. Lately, we've been discussing trade-offs and their financial impacts. One common topic with clients is life expectancy, as I firmly believe in the insights provided by actuarial science.

Actuarial science thrives on large numbers. For instance, insurance companies can predict with remarkable accuracy how many out of 100,000 men my age will be alive or deceased by year's end. This level of precision is unattainable on an individual basis. We've all heard stories of doctors predicting a few months left for someone, only for that person to live much shorter or much longer than expected. So, how do we navigate these numbers?

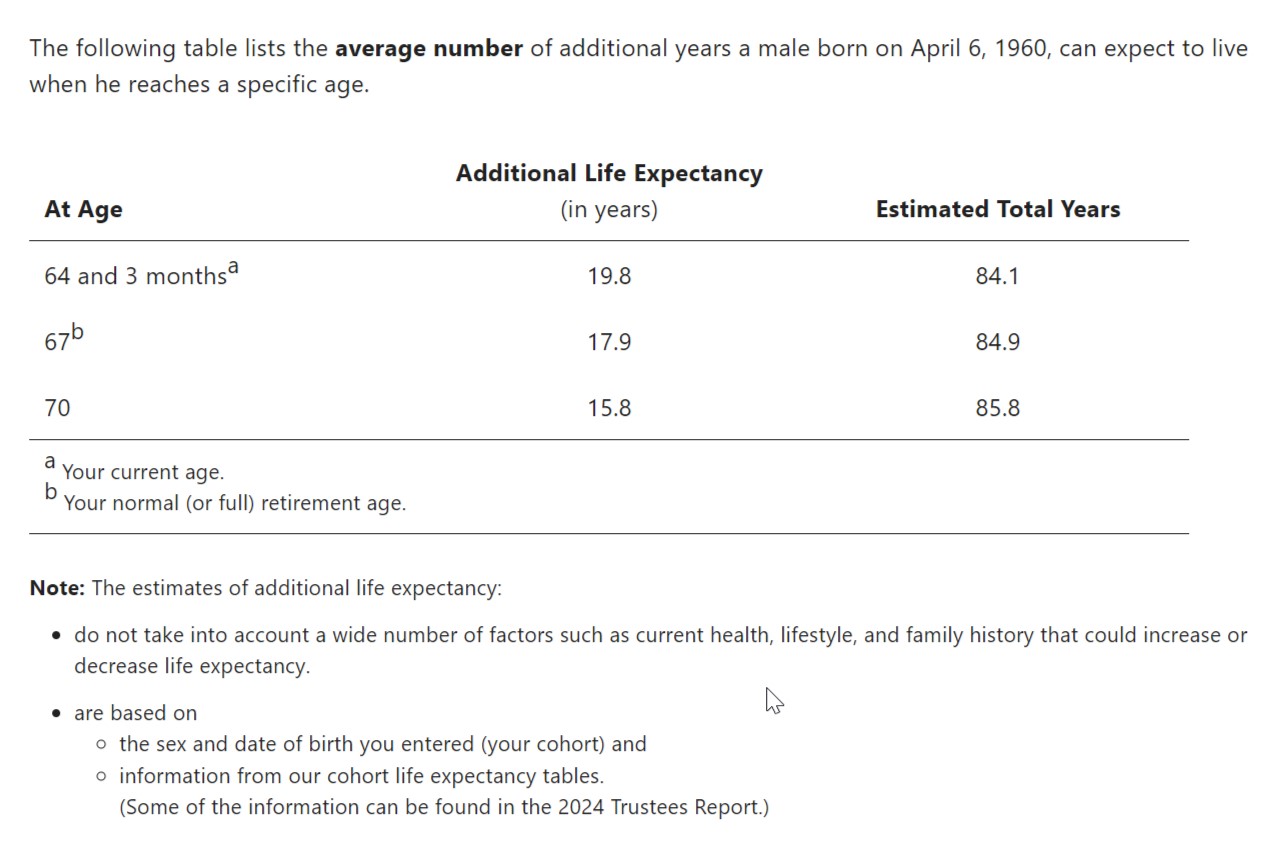

I decided to calculate my own life expectancy, starting with the Social Security Administration's website. By entering my birth date and gender, it estimated my life expectancy at 84.1 years based on population averages.

However, I don't consider myself average. I used another website that factored in my habits, health, education, and career. This increased my life expectancy to 89 years.

I then looked at my family's history. The men in my family often live into their 90s, so I chose my death date as the day after my 105th birthday, April 7, 2065. While these numbers aren't rooted in reality, once my obituary is written, the actual date will be set, and it will be too late to adjust my financial plans.

How do these calculations relate to trade-offs? In retirement, decisions like choosing between a pension and a lump sum are crucial. With a 401K or an IRA, the challenge is to ensure we don't outlive our money.

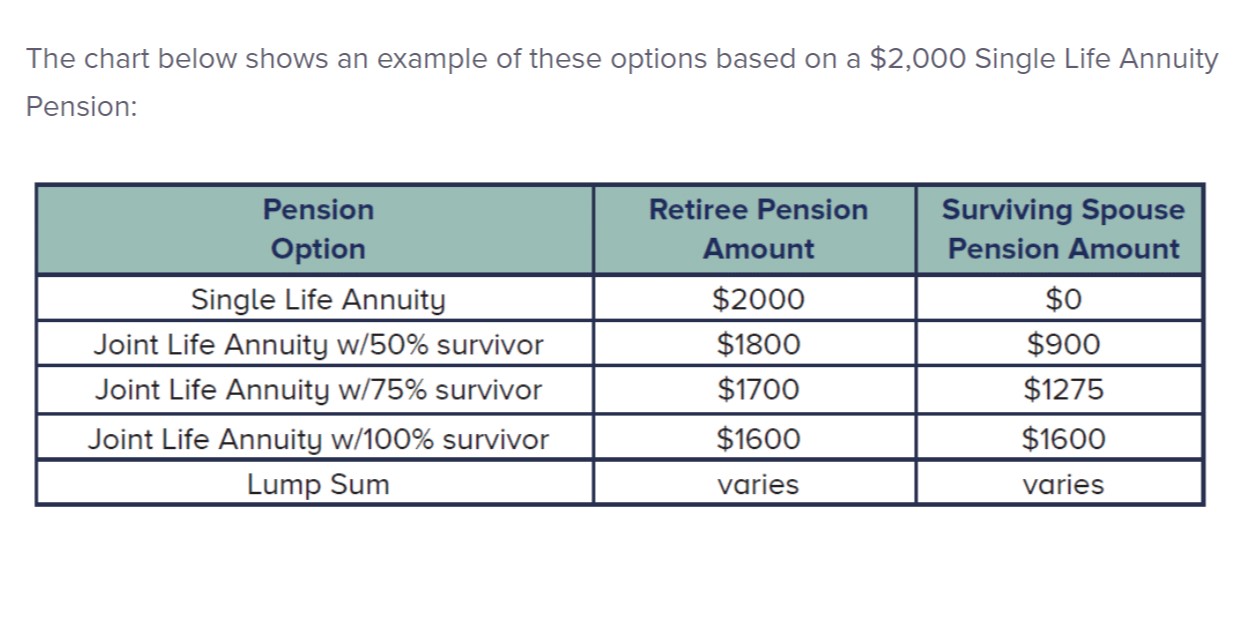

Here's an example of how pensions or immediate annuities work. Let's say you retire at 65 with $350,000. How do you make this last? You could opt for a pension or immediate annuity, offering $2,000 monthly for life in exchange for the $350,000. If you're married and want to secure income for your spouse, you might receive $1,800 monthly, with your spouse getting $900 if you pass first. For more security, you could accept $1,700 monthly, ensuring your spouse gets $1,275, or $1,600 monthly, guaranteeing your spouse $1,600.

Is this a good deal? If you outlive the average expectancy, the pros include a guaranteed income for life and financial security for your spouse. Conversely, taking a lump sum offers more control but also market risk. There's the possibility that your spouse may not outlive you, making the lump sum advantageous for leaving money to beneficiaries.

Ultimately, the decision involves a significant and potentially permanent trade-off. What's the best choice for you, your family, and your future? This decision is too important to make alone. We're here to guide you through these questions—it's time to schedule your Financialoscopy®.