We have been going through different people that can affect your life and your financial life from our deck of twenty-financial Financialoscopy® cards. Today, we discuss “Crazy Cousin Carl”. We all have one. He might be a cousin, an uncle, a brother, father, or a sister or mother. This could also be someone that you work with. This card says it all.

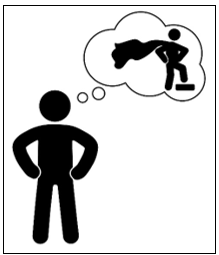

This is the person who thinks that he or she is Superman or Superwoman. This is the “know-it-all” in your life.

When I am with family and friends, I don’t like to talk about business because it’s my “family time”. I cannot tell you how many people have approached me at a dinner or holiday party, when I’m with friends or family, and they asked me, “So what do you think about the market?” Here’s the deal: they don’t really care what my thoughts are, which I wouldn’t share anyway because I don’t know anything about their financial life. For me to give an opinion to someone when I don’t know anything about them financially would be malpractice. An attorney can’t give random legal advice because they don’t know if the advice would be appropriate for that individual. A doctor can’t fill out a prescription for a random person because they don’t know how it may affect that individual. I’m the same; I can’t dispense advice to someone whom I don’t know. Besides, that person asking the question really doesn’t want to hear my answer anyway. They want to hear their own voice. They want to tell me what they think is happening in the market.

Before the tech bust in the late 1990s, when I would get together with family and friends, it was amazing how many wanted to talk about what they were doing in the market. I knew people within my own circle of family and friends who were day trading. Whenever I got together at parties or reunions, everybody was talking about their money, what they bought, how long they were holding it for, etc. The amazing thing was that as soon as the market went bust, all those conversations ceased. You know why? All of a sudden, the people who thought that they were so very smart when it came to the market were silenced and humbled by the reality that they did not know what they were doing.

I saw the same thing leading up to 2008. Everybody wanted to talk about the market, but more specifically they wanted to talk about what they were doing in the market, until there was a turnaround in 2008. That’s why I always like to say, “Everything is fine and dandy until it’s no longer fine and dandy.” When things go well, there’s always that one person with big opinions who always needs to share, based on nothing but their own experiences. I like to call them “Crazy Cousin Carl”.

If you want to hear advice based on our experiences and if we can provide that advice because it is appropriate after getting to know who you are, what you believe, what your experiences are and what you bring to the table, then today is the day to schedule your Financialoscopy®.