We receive bills every single month, but do you audit your bills to ensure that you're paying the correct amount? I know you know to check your credit card statement each month. I go through mine line by line, and over the years, I've found errors. I've discovered extra tips added or items I didn’t purchase, requiring me to contact the credit card company to make adjustments.

However, there are some types of bills I just assume are accurate. So, imagine my surprise the other day when I was reviewing my utility bill and I found an error. Yes, my life might seem boring because I scrutinize bills, but I enjoy my boring life. I've been in the same home since 1991, and for a long time, I've been on a plan with our utility company that averages charges over the entire year. This means I might be slightly overcharged during the summer months and slightly undercharged during the winter.

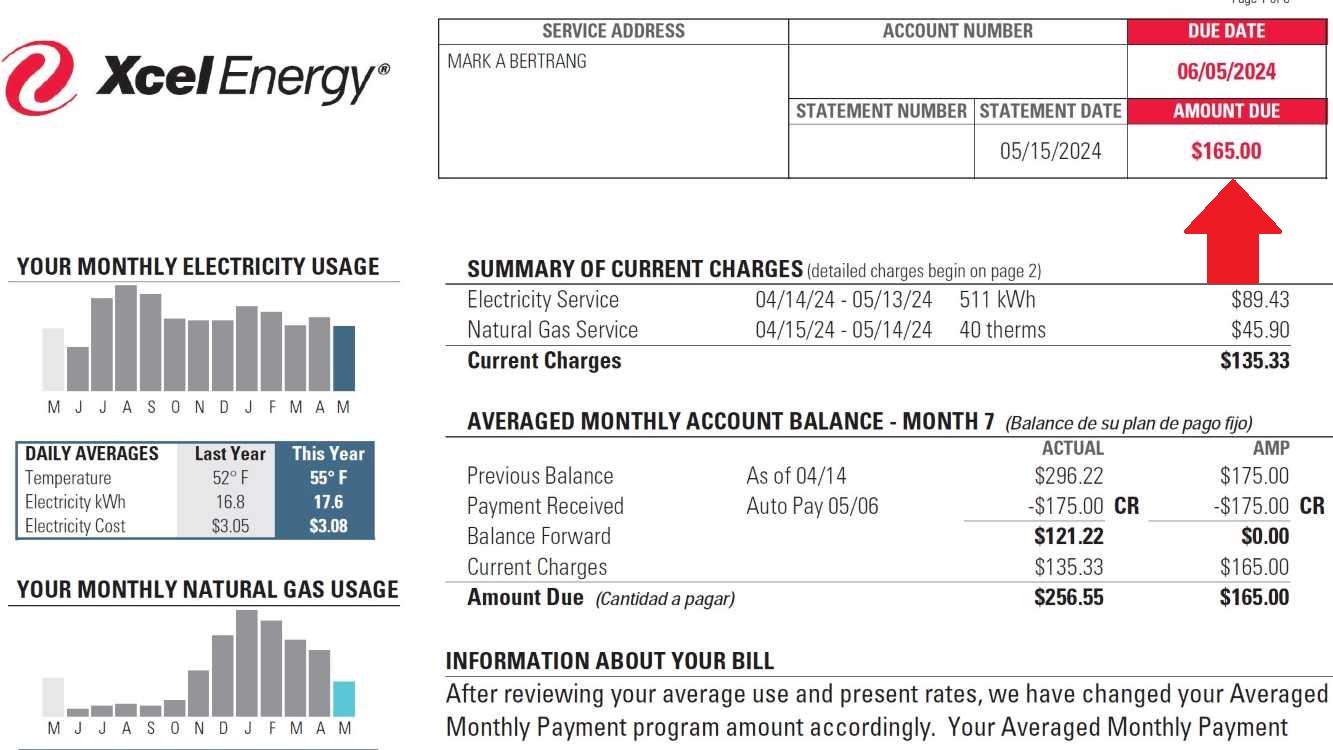

For example, here was my bill due in June: my actual charges were $135, but my monthly payment was $165. That $165 is set up for auto-pay from my account each month.

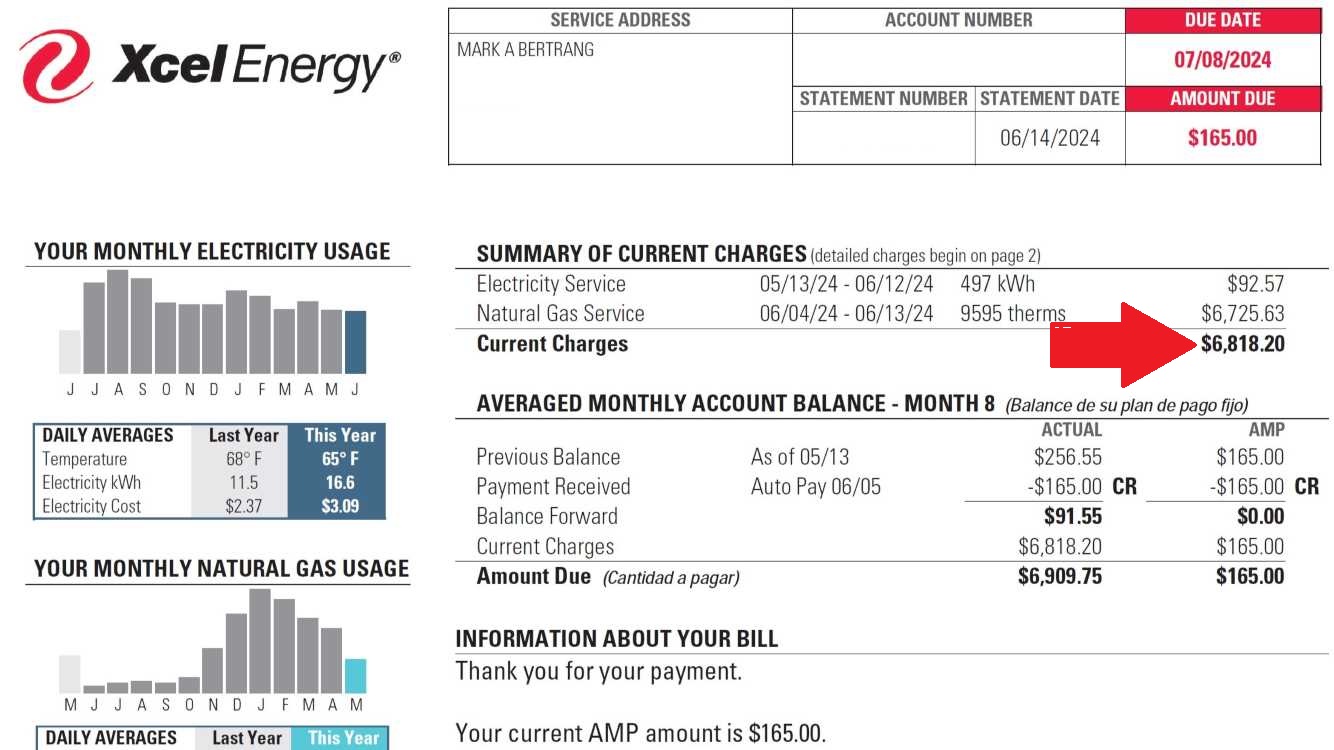

I always review the bill and make a note in my checkbook registry. I strongly suggest you do the same. Now, let’s look at July: once again, my monthly payment was set at $165, but what are these current charges of $6,818.20? I’ll be honest—I didn’t notice this because I was only focused on the due date and the amount owed. I noted $165 in the registry, deducted the amount, and moved on.

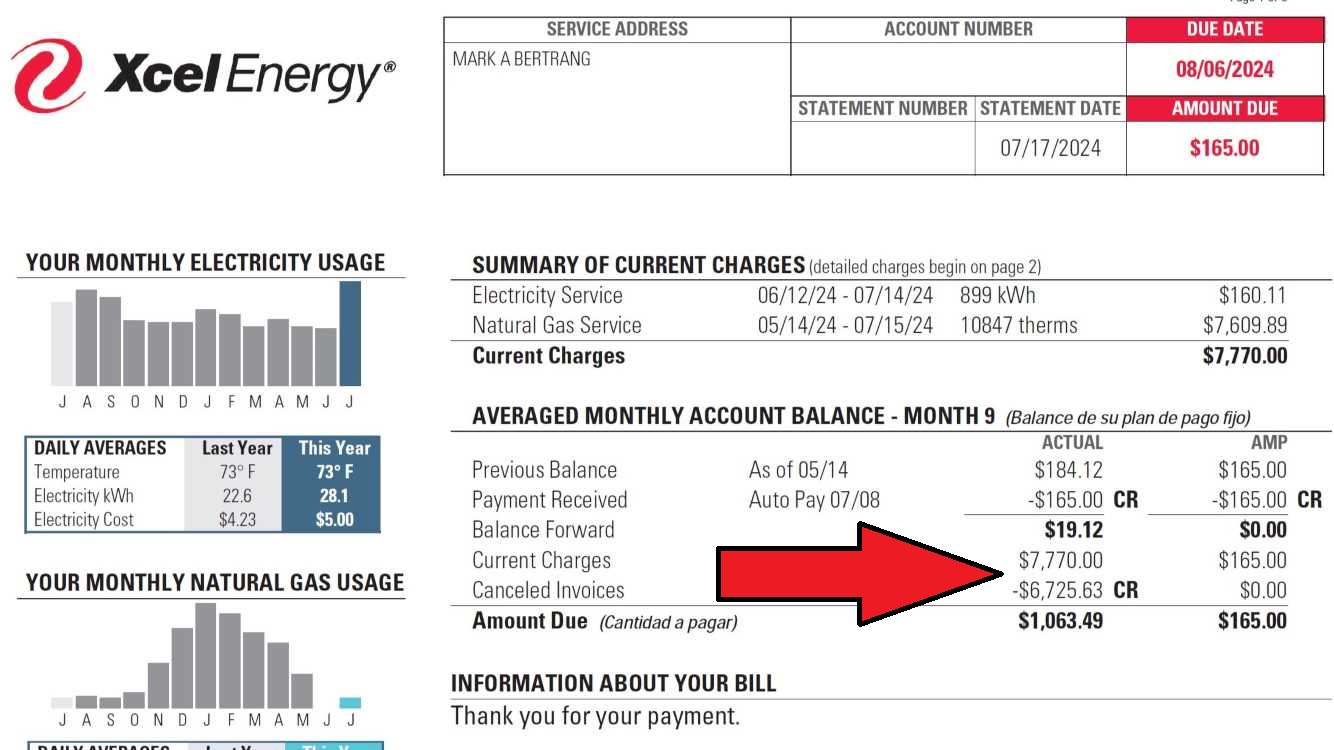

Here was our August bill: once again, I missed the error. I don’t like to get bogged down in details. The charges were supposed to be $165, but looking back now, I can see all this crazy stuff happening. I had current charges of $7,770, but then there was a credit of $6,725.63.

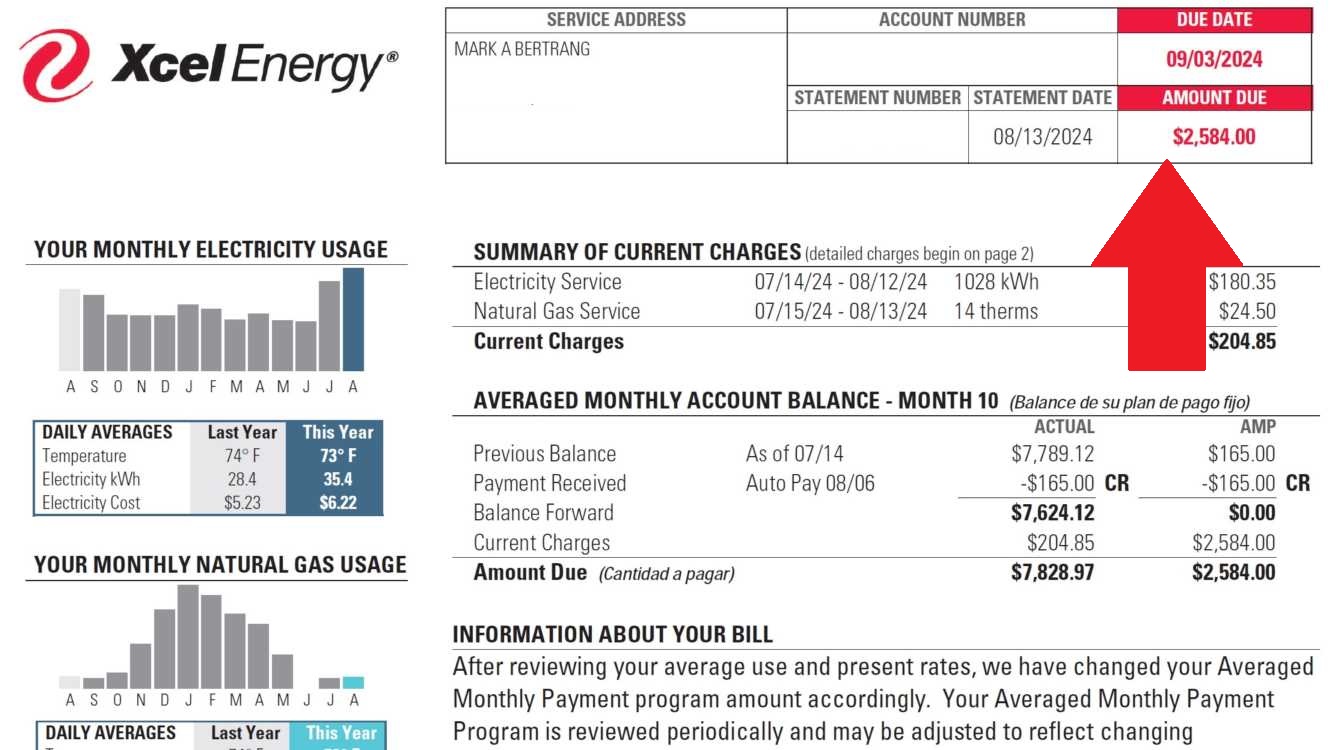

Finally, the next month caught my attention when the company decided to adjust my “average” payment. The amount that was going to automatically come out of my account was going to be $2,584! This definitely got my attention. I noticed a previous balance of $7,789.12. Curious, I calculated the difference between my previous average and these new charges—it was almost 4,000%!

When I got home that night, I called the 1-800 number to resolve the issue, but after waiting 20 minutes and starting to explain the problem, we got disconnected. The next morning, I tried again. Finally, I was connected to a really nice service representative named Jamie. I said, “I’m going to tell you what’s going on, and hopefully, you can solve the problem.” Jamie and I were on the phone for well over half an hour, but we think we resolved the issue.

Here’s the thing: you should review all of your bills, especially the ones that no longer come in the mail and are only available online. Don’t just look at the total amount; check all the subcategories. Imagine if I hadn’t checked the bill and waited until the end of the month to balance my checkbook, only to discover a charge of $2,584. That’s a shock I wouldn’t want to experience.

Don’t assume everything is always going to run smoothly. Jamie said it appeared to be a typo. I didn’t think people could still make typos with everything being automated. From what I understand, they occasionally read the meters manually, and Jamie said someone probably looked, tested the meter, and then made a typo when entering the number.

You don’t want to deal with a “typo” problem. Make sure to balance your checkbook and closely review your bills. Are you using those services? Did you receive the items you were charged for? Every single month, take 5–10 minutes to do this because this directly impacts the efficiency of your money.

If you appreciate the unique concepts and thoughts we regularly share with you, perhaps it’s time to consider scheduling your Financialoscopy®.