I remember one time that everyone in my class went to a local park and in this park, there was a metal chain maypole. I tried to find a picture of what one of these looked like and I had to go back to 1924 because most parks started getting rid of them.

The reason it no longer exists in the park of my hometown may be because of what I saw happen that day in 5th grade. My best friend Michael, who later became my best man, and I were walking together. We were watching the other boys on the maypole. As you can see, you would all hang on to the chain. Someone would pull as hard as they possibly could and one at a time, one of the other boys would ask to be let out and they would go spin around horizontally because all the other boys were pulling and pulling on the chain. About the time that you couldn’t hold on any longer, you would ask them to let you back in so your feet could get back on the ground. On this particular day, when Bob asked to be let in, the other boys thought it would be hilarious if they just kept on going. So, Bob stayed horizontal until he could not hold on any longer. He let go. I never saw an arm with two elbows before. Imagine the impression that made. That's where we will begin today. We're going to talk about being stuck and not being able to get back safely to the ground because of interest rates.

Recently, I was reading The Wall Street Journal and I came across this article discussing where department stores make most of their money, and I wasn’t surprised by this: credit card income. This is based on credit cards that stores have issued to their customers. This accounted for 49% of the operating income for Macy’s and 44% of Nordstrom’s operating income for 2022. Late fees are especially important for store credit cards. Late fees make up about 25% of credit card issuers' total interest and consumer fees. Bank of America’s global research and Citibank’s research estimate that late fees represent between roughly 14 - 30% of the overall credit card portfolio revenue. The article went on to say that department stores often dangle discounts to customers who sign on to their brand credit cards because that is where they make their money. They’re not making their money by selling their stuff. They’re making money by financing stuff.

The reason that I’m bringing this up is because automobiles work the same way. Most car companies make the majority of their money by financing their automobiles. I'm going to go through the math with you because many people think they got a great deal with a 0% interest rate. People... Think about this: do you really think that the automobile company loves you so much that they are going to provide you with free money? Let’s look at the actual math.

If I am buying a $50,000 car and divide that into 60 payments over 5 years, then my payments would be $833.33. Now, let’s pretend that you are taking out a loan for $50,000. You will make monthly payments. So, on this calculator, I am going to input my $833.33 payment. I’m going to assume that if I pay that amount for 60 months, the future balance of that loan is going to be zero. You can then see that the annual interest rate is 0.00%.

Do you really think that the car company is willing to give you this deal? No, they’ve got to make money. Do your own research online and you will discover that financing is where they are making the most money.

With that in mind, how do we figure out what the interest rate really was? Let’s pretend that instead of having a 0% interest loan at $50,000 you walk into your dealership and tell them you either have the cash in hand or that you can write them a check today. If they’re offering a 0% interest rate on a $50,000 car, don’t you think that you’re going to be able to cut a better deal if you come with cash? Yes, they are going to give you a huge discount because you’re going to be writing a check that day. Now, if you ever go into a dealership, they will either give you 0% interest or they will give you some bonus amount of money off of the car. You never, ever get to have both. They have already computed where to make money in those two scenarios.

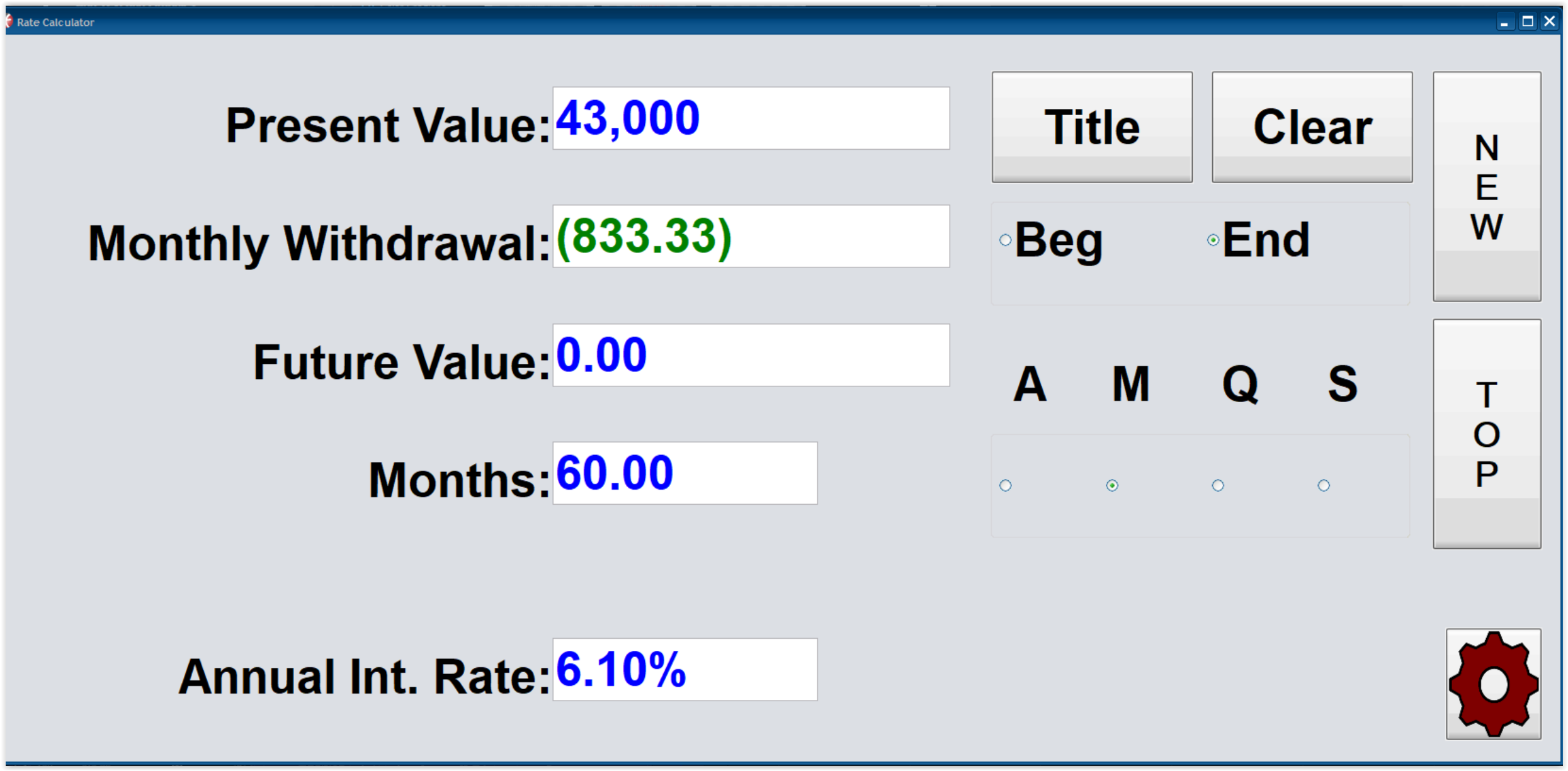

Let’s figure out the actual interest rate. Again, we’re looking at $50,000. To do a mathematical calculation, you can only change one thing at a time. When you do an experiment, you can only change one thing at a time. So, I have to keep the monthly payment exactly where it was at $833.33. The future value has to remain the same $0.00. The number of months is 60 months. Let’s say I walk in with cash and they’re willing to give me a huge discount that brings the cost down to $43,000. Everything else is the same, but you can see the effective interest rate is 6.10%.

If you were to do this and then ask for the 0% interest, guess what, you are not going to get the 0% interest because now you’ve changed two things. If you want the 0% interest and still want the $43,000 discount, that’s going to be a non-starter.

What does this have to do with what Michael and I experienced as our friend Bob came flying through the air, landed at our feet, and developed an extra elbow that we had never seen before? It’s the trust that everything is going to be fine because you’re trusting that these people who are spinning you around are going to let you come back to the ground. Remember, just like the credit cards, the automobile companies are making their money in financing. If you are looking at a 0% rate, you are like Bob. You’re flying horizontally and you believe that when you ask to be let in, you will actually be let in.

If you want more information on how this math works, sit down with us and we will slowly go through the calculations with you. Perhaps it’s time for you to schedule your Financialoscopy®.